Search This Supplers Products:Pipe FittingsPipe bend and ElbowSocket pipe fittingsTeesFlangesSteel pipes

THE FUTURE OF THE STEEL INDUSTRY: SELECTED TRENDS AND POLICY ISSUES

sourceYAHOO

publisherAnna Su

time2016/11/29

- The Future of the Steel Industry

1. Steel demand outlook is quite strong in the long

term

2. Material substitution and steel

3. Factors that will improve the competitiveness of the

steel industry

4. Steelmaking capacity and impacts for the future of

the industry

5. The sustainable development of the steel industry

6. The need to ensure open markets for steel

7. The role of state-owned enterprises in the steel

industry

8. Issues for discussion

With today’s economic development, the steel industry future has been an important issue for us to discuss. Whether the steel industry has a bright future? Or this industry has been an sunset industry? This is the main question for many steel companies. In order to disclose this industry’s future veil, we need to discuss several factors influence the steel industry.

1. Introduction

• Steel: bright future as a material but uncertain outlook as an industry – Steel will remain one of the most important materials for modern societies; – However, steel industry faces huge challenges: overcapacity, volatility of raw materials and energy markets, risks of protectionnist policies…

• This presentation aims to : – Highlight some future trends for the steel industry – Raise main questions on the viability of the steel industry in the long term

2. Steel demand prospects

• Global steel demand is expected to increase to 2.3 billion tonnes in 2025 (CAGR of 3.7%)

2. Steel demand prospects

• Slowdown of global steel demand growth driven by:

– Reduction of China’s contribution with slower and more service-oriented GDP growth,

– Modest steel demand growth in advanced economies,

– Less quantity of steel per unit in several industries.

• 90% of the expected increase in 2011-2025 from:

– Construction driven by residential and infrastructure projects in emerging economies (68% of the increase),

– Mechanical engineering (13% of the increase),

– Pipelines, “oil country tubular goods” (OCTG) and other tubes (9% of the increase).

3. Material substitution and steel

• The most viable substitute is aluminum

• Research by All wood and Cullen (2012):

– Wood, stone and concrete other substitutes but with less favorable properties than steel.

– Trends in the way steel is made and used:

• Using less steel through improved product design,

• Reducing yield losses,

• Longer life products.

4. Factors that will drive the

competitiveness of the steel industry

Blast furnace and EAF cost drivers in September 2012 % of total operating cost

4. Factors that will drive the competitiveness of the steel industry

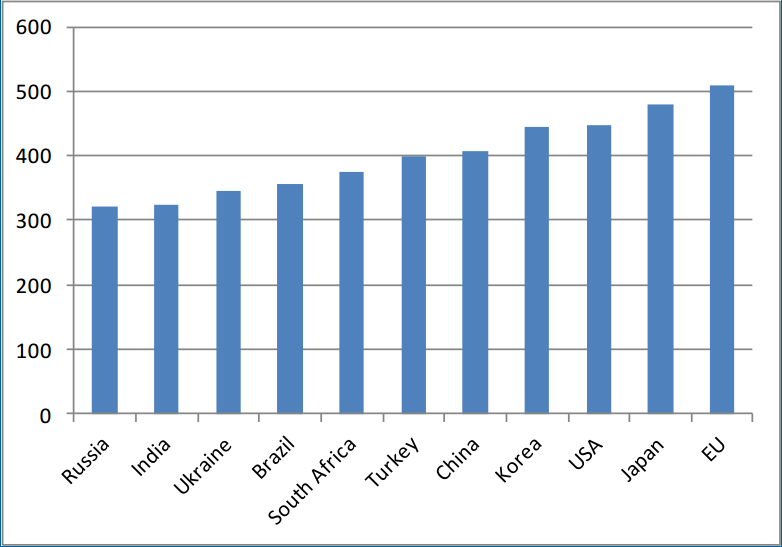

Operating costs for BF/BOF processes USD per tonne of billet produced

4. Factors that will drive the competitiveness of the steel industry

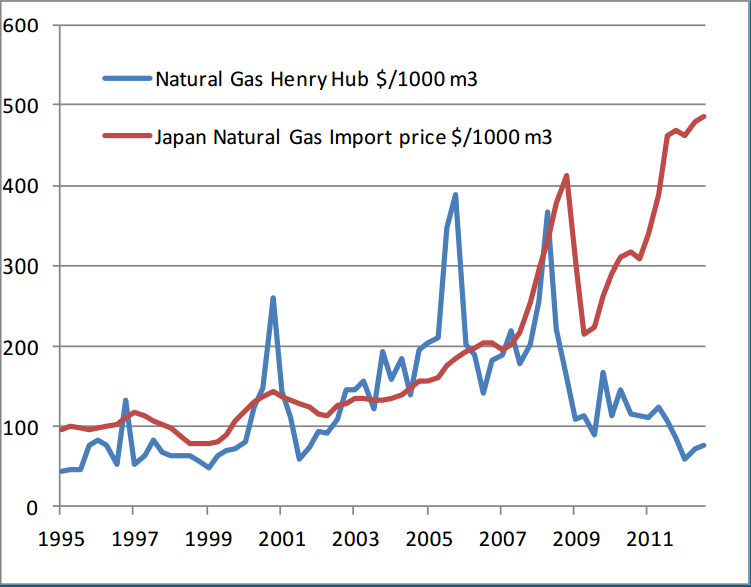

International natural gas prices USD per 1000m3

5. Steel making capacity

• Further growth expected in steel making capacity.

– It would increase the risk of over-supply, trade frictions, low prices and weak profitability.

– A problem particularly for mulch-plant companies.

• Principal challenges for policy makers:

– To discourage market-distorting practices that foster the installation or maintenance of inefficient capacity.

– To enhance trade in steel which is a way to offset the need for building new capacity in other regions.

6. Sustainable development of the steel industry

• 2nd largest industrial user of energy

• 1st largest industrial CO2 emitter

• Large progresses made but much more to be done:

– Between 1975 and 2004, energy efficiency increased by almost 50% (driven by capital stock turnover, growing share of electric arc furnaces, process innovation).

– Carbon Capture and Storage (CCS) and breakthrough iron and steel-making technologies will be needed.

• Other challenges: how to reconcile social,environmental and commercial (e.g. Land acquisition problems for new steel plants)

7. The need to preserve open markets for steel

• Protectionist policies and subsidies can exacerbate crises in steel, notably:

– Non-tariff barriers on steel imports,

– Export restrictions of raw materials,

– Measures that favour over-capacity.

• These measures can lead to the adoption of similar policies in competing markets

• The health of the steel industry will depend on:

– Policies that keep markets open and;

– Policies that do not shift the burden of adjustment to other countries.

8. Ensuring competitive neutrality between private and state-owned enterprises (SOE)

• There are 35 SOEs among the 128 largest steelmakers representing 29% of the crude steel production of these companies.

• SOEs can potentially enjoy significant competitive advantages over competitors.

• These advantages do not exist in countries that implement “competitive neutrality”